Prediction Markets in 2026: How They Work and Why Everyone Is Talking About Them

In recent years, in many news articles, reviews, and discussions, the term “prediction markets” keeps appearing more often. Let’s figure out what they are, how they work, and why interest will continue to grow in 2026.

What Are Prediction Markets in Simple Words

A prediction market is an online platform where users trade the probabilities of real events. Instead of traditional odds, these platforms use contracts whose prices reflect the likelihood of an event happening. Basically, by its price, the market answers the question: how likely is this outcome right now?

Prediction markets are used in many areas:

- sport

- politics

- economy

- cryptocurrencies and technology

- culture and show business

- various trends

The final price of a contract is the collective opinion of all participants expressed in money.

How Prediction Markets Work

The mechanics of prediction markets are based on classic market principles:

- every contract has a price from $0 to $1 (or in USDC)

- the price is the probability of the event

- participants can buy and sell shares of the contract at any time

Example:

If the share of the contract “Bitcoin will break $150,000 in 2026” costs $0.20, that means the market (the people) estimates the probability of this event at 20%. If the event happens, each share becomes $1, and you earn $0.80 for every $0.20 invested. In other words, from a $100 stake, you get $500 ($400 net). If the event does not happen, the share is worth 0 and you lose your entire stake.

Important point: you can sell shares at any moment before the event ends, locking in profit or loss early — like on a stock exchange.

How Is the Price Formed?

There are two kinds of markets:

1. Centralized. There is an operator (a company or legal entity) that decides which markets to open and what probabilities to set. They can freeze accounts and define settlement rules. This kind of market is usually available only in the USA or certain states and uses geo-blocking. The operator works under the law and often under regulators’ supervision. Users are protected and the company has legal status.

Bets and settlements happen in USD, and bank cards may be used. Payouts can be canceled or frozen depending on the operator’s decision.

2. Decentralized. There is no “admin” in the traditional sense. Logic is written into smart contracts. A person trades with other people and the price is formed by market participants. Rules cannot be changed retroactively. Everything is transparent and open. There are usually no blocks. Access is done through a crypto wallet. Restrictions may be at the site level (VPN may be needed).

Often the market is in a “grey area” without a classic license. All risks are on the user and in case of dispute there is no one to complain to. Bets and settlements are done in cryptocurrency and contract payout is automatic.

Who Decides That an Event Happened?

- Centralized – the operator. They use official data sources. Appeals and revisions are possible.

- Decentralized – oracles (independent outside experts). They propose the outcome and give time for challenge. If no one disputes it, the payout happens.

Top-5 Decentralized Prediction Markets

Here are markets that are available to users in many regions:

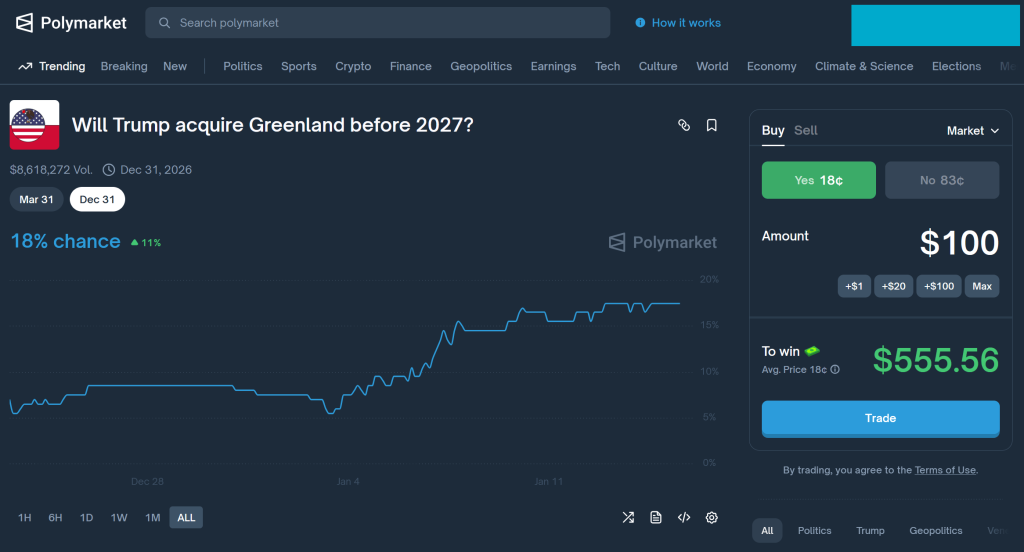

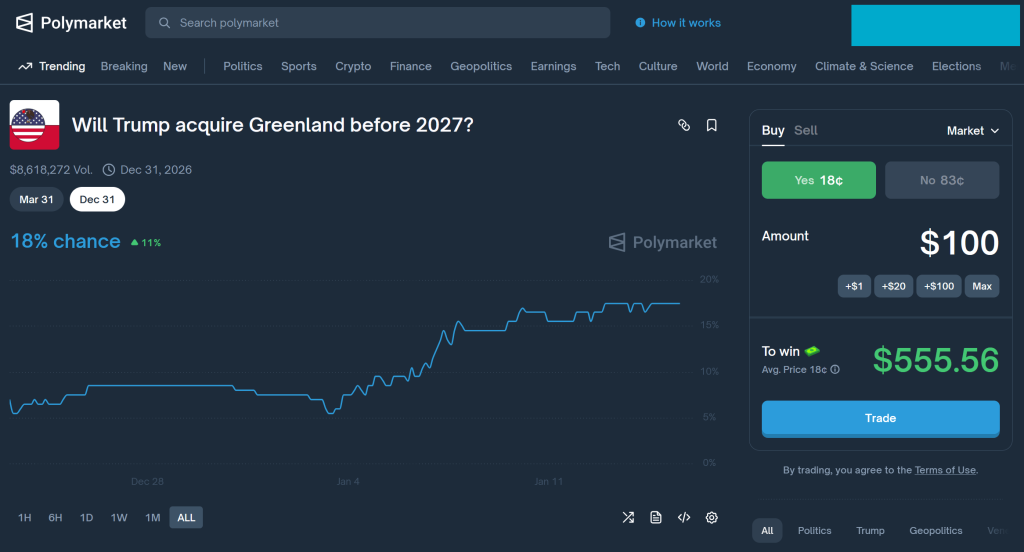

Polymarket

Launched in 2020, Polymarket is a platform built on the Ethereum and Polygon blockchains. Stablecoin USD Coin (USDC) is used for betting. The platform quickly gained popularity. In July 2024, Polymarket’s trading volumes jumped from $100 million to $380 million due to interest in the US presidential elections. This contract gathered more than $505 million in stakes. In 2026, Polymarket is the largest platform.

The main advantage is liquidity and mass participation. Real money comes here. Polymarket is followed by journalists, analysts, and even politicians because its prices are often more accurate than polls.

Hedgehog Markets

Launched in 2022, built on Solana, Hedgehog Markets calls itself a “next-generation prediction market.” Here you can create markets on almost any event, and trading is done through a liquidity pool supported by liquidity providers.

Its distinctive feature is the attempt to combine AMM (automated market maker) mechanics with prediction markets to reduce spreads and improve prices.

Projection Finance

The newest platform – launched in 2023. It is built on the Ethereum blockchain. It aims to use blockchain transparency to offer users a reliable way to create contracts. Here smart contracts are used, which ensures fair execution of all transactions without intermediaries.

Its distinctive feature is that users bet on future values of financial indicators, not just the winner of a game or election outcome.

PlotX

PlotX was launched in 2020 and runs on the Ethereum blockchain. The platform is often called the “Uniswap of prediction markets” due to its use of AMM, which removes risk for users.

Its distinctive trait is short time frames (often hours), making it similar to crypto-forex in miniature and attracting traders.

DexWin

Launched in 2022 and using Ethereum and Polygon, DexWin lets users quickly deposit and withdraw funds. DexWin allows markets on many different events, and settlement happens through AMM pools where liquidity holders earn a part of fees from prediction trading.

Its distinguishing feature is the focus on integrating the prediction market into a DEX ecosystem so that participants can easily switch between trading assets and trading expectations — without moving to separate apps.

Why People Talk More About Prediction Markets and What Will Happen in 2026

In 2024–2025, prediction markets moved from an experimental niche to a full market. The combined turnover of the largest platforms reached $35–40 billion. Thousands of markets were active at the same time. Certain events (elections, finals of big tournaments) gathered hundreds of millions in liquidity, which is already comparable to top bookmaker lines.

From 2025, large players have actively entered the segment:

- The NYSE owner invested about $2 billion in infrastructure, giving the project a valuation near $9 billion and strengthening relationships for international data and product distribution.

- Fanatics Markets launched its own sports prediction app in 24 US states at the end of 2025.

- FanDuel (through a partnership with CME Group) is developing event-oriented markets as a separate product.

- DraftKings acquired Railbird technology to enter the prediction market and is preparing the product integration.

Today, prediction exchanges are no longer just “bets without a bookmaker.” They are tools that measure society’s expectations in real time. A vivid example is the market around the mythical “ninth episode” of season five of Stranger Things. Users of Polymarket placed almost $10 million on the chance it would be released, turning a rumor into a full market indicator of interest.

Such cases show that prediction markets go beyond sports and politics and become a universal barometer of public opinion — from economics to pop culture. For this reason, their further growth is expected in 2026.